🌍 Why Your Money Shouldn’t Stay in One Place

How to build wealth by tapping into the world’s biggest opportunities

Most people grow up thinking about money in local terms — our job, our home, our city.

But we live in a global economy, and the opportunities available to us stretch far beyond our postcode.

One book that captures this mindset well is How to Own the World by Andrew Craig. It’s a great introduction to the idea that your financial future shouldn’t be tied to one place — a principle that has shaped how I think about wealth-building and how I teach financial education.

The world is bigger than we often realise — and your money should be part of that bigger picture.

🌐 The World Is Growing — But Not All in the Same Way

Last week we talked about the S&P 500 — a massive index that makes up almost half of the world’s stock market value. Many of its companies operate globally, which is part of why it’s so influential.

But even with that global footprint, the S&P 500 is still mainly tied to:

US companies

The US market

The US dollar

The US economy

So while the businesses are international, your investment exposure is still mainly tied to the US market.

And that means it doesn’t capture everything happening in the rest of the world. There are fast-growing regions, emerging industries, and entire asset classes that sit completely outside the S&P 500.

📌 So the question becomes:

If the world has multiple engines of growth, why rely on just one of them?

A global approach means you benefit from progress wherever it happens — not just where you live or the U.S.

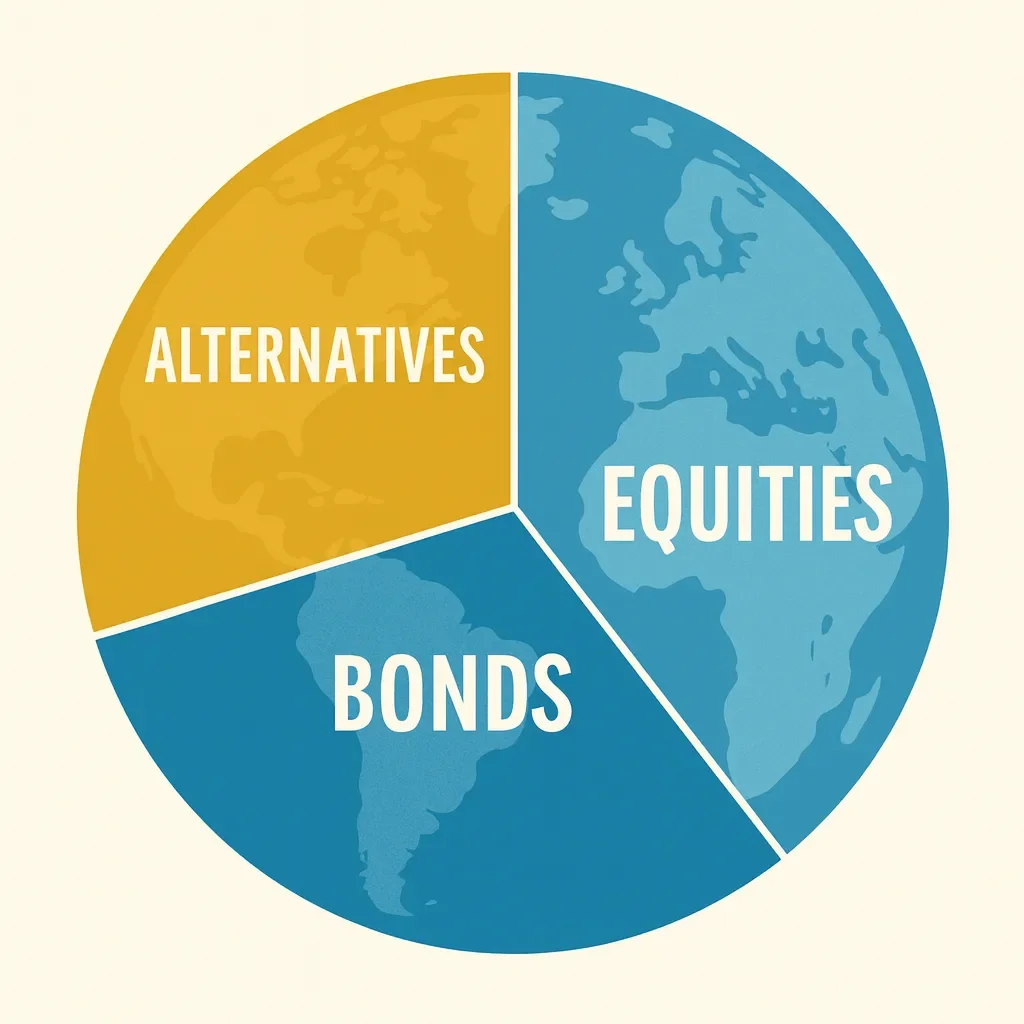

🧭 What “Owning the World” Actually Means

It doesn’t mean picking every country one by one.

It just means giving your money a wider reach in a simple, practical way.

The easiest way to do that is through broad global funds — investments that already include companies from many regions, sectors, and economies inside one single product.

This lets you own a small piece of lots of different places and stories, without doing all the choosing yourself.

1️⃣ Global Equities — Companies Building the Future Worldwide 📈

When people think about investing, they often think of the U.S. or Europe. But innovation is happening across the entire world:

new tech hubs

growing middle-class populations

digital industries

renewable energy

mobile-first financial services

By investing globally, you benefit from these different regions growing at different speeds — and in different ways.

You’re not dependent on one country or one economic cycle.

You’re connected to the world’s progress.

2️⃣ Bonds — The Steady, Reliable Part of Your Portfolio 🛡️

A bond is simply a loan you give to a government or a company.

You lend them money

They pay you interest

They return your original amount at the end

Bonds add balance.

They help smooth out the journey when markets become unpredictable and offer more stable returns.

If equities are the engine of growth, bonds help keep the ride steady.

3️⃣ Alternatives — More Ways to Build Stability and Growth 💎

Alternatives add diversification because they behave differently from stock and bond markets.

This can include:

property

commodities like gold and silver

digital assets

Gold and silver, for example, have acted as stores of value for thousands of years.

They don’t rely on governments or central banks — and their limited supply makes them a natural inflation hedge.

Alternatives aren’t about chasing trends.

They’re simply additional tools that help create resilience in your long-term plan.

🏠 Property Is Great — But It Shouldn’t Be Your Only Investment

A lot of people avoid the stock market because they think it’s “too risky.”

Ironically, their biggest investment becomes the home they live in.

That means:

one asset

in one location

tied to one economy

exposed to one property market

Property can be a powerful part of your financial story — but it shouldn’t be the whole story.

There’s a world of opportunity beyond your front door.

🌱 Why a Multi-Asset Approach Matters

Combining global equities, bonds, and alternatives gives you:

access to global innovation

protection during downturns

exposure to long-term trends

stability across economic cycles

You don’t need to predict the next big thing.

You simply own a piece of everything — and let the world’s growth work for you.

🚀 You Don’t Need to Be an Expert to Start

Investing isn’t about knowing everything.

It’s about taking clear steps, learning as you go, and giving yourself room to grow.

We’re living in a time where information and tools are more accessible than ever.

Once you understand the basics, global investing becomes far less intimidating.

Your future doesn’t have to be limited to the place you live.

You can build a financial life that grows with the world.

🎓 Want to Put This Into Practice?

I’ll soon be running a session to help you understand:

how global investing works

how to build a simple multi-asset portfolio

how to diversify confidently

how to invest with long-term clarity

If you want the details, send me a message.

The world is expanding — and your wealth can expand with it. 🌍✨