Why Time Is the Most Powerful Asset for Young Professionals

How small, consistent steps today can build massive wealth tomorrow.

If you’re in your 20s or 30s and haven’t started investing yet, it’s not too late, but it is the best time to start.

You’re just beginning to earn more. If you start investing regularly now, those routines will carry you through your career and set you up for long-term success.

Time, when used wisely, is your most powerful financial ally.

I’ve worked with and mentored many young professionals — and seen first-hand how easily your income can vanish into rent, bills, and the everyday cost of living. But I’ve also seen how small, consistent steps taken early can completely shift someone’s future.

This isn’t about trying to time the market or having a huge income. It’s about letting time and consistency do what they do best, quietly build your future.

⏳ Let Time Do the Heavy Lifting

The earlier you start, the more your money can grow through compound interest.

Even small amounts make a difference.

For example:

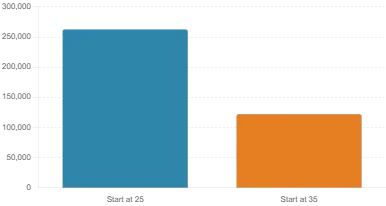

1. Start investing £100/month at age 25 (earning 7% annually) → grows to £264,000 by age 65.

2. Start at age 35 with the same £100/month → grows to just £123,000 by 65.

That 10-year head start more than doubles your final amount — not because you saved more, but because time had more room to work its magic.

You don’t need to try and time the market. Even professional investors with armies of data and resources struggle to beat it consistently.

You don’t need to be a financial expert to start investing.

🚀 Automate It and Make It Work

If you feel like you don’t have enough to invest, here’s what helped me: salary sacrifice.

It means a portion of your salary goes directly into a pension or investment — before it hits your bank account. You don’t see it, you don’t miss it, and it’s tax efficient too.

There are other tax-smart options worth considering:

Lifetime ISA (LISA): Save up to £4,000 per year, and the government adds a 25% bonus — up to £1,000 free every year. You can use it for your first home (up to £450,000, with conditions) or for retirement (from age 60).

Stocks & Shares ISA: Invest up to £20,000 each tax year, with all growth, dividends, and withdrawals tax-free.

Remember: the £20,000 limit is the total across all ISAs each tax year.SIPP (Self-Invested Personal Pension): Gives you full control over your retirement investments. For the self-employed — yes, I’m talking to my day-rate brothers and sisters — this is crucial since you don’t get employer contributions. The government adds at least 20% tax relief, with higher earners able to claim more through self-assessment.

🎓 Invest in Yourself Too

While your money grows in the background, don’t forget: investing in yourself is just as powerful.

After nearly a decade in financial services — and teaching hundreds of students and professionals about money — I’ve seen that the biggest returns often come from improving your skills, building your confidence, or learning something new.

Self-investment never suffers from inflation. Nobody can tax your skills.

You are an asset to yourself.

🙏 Final Thought: Use What You Have, Start Where You Are

You don’t need to wait for perfect conditions, you just need a plan.

Start with what you have: open that ISA, speak to someone about your pension, automate £20 a month.

Progress comes from small, consistent actions. Your future self will thank you for starting today.

💬 Which of these will you start with — LISA, Stocks & Shares ISA, or a SIPP?